Retirement Cap 2024

Retirement Cap 2024. The need to plan for long and potentially expensive retirements continues to shape the retirement landscape for 2024. 401 (k) pretax limit increases to $23,000.

For 2024, employees may contribute up to $23,000. Irs announces 2024 retirement account contribution limits:

And For 2024, The Roth Ira Contribution Limit Is $7,000 For.

Learn about the 2024 contribution limits for different retirement savings plans including 401k, 457, 403b, 401a and iras.

$23,000 For 401(K) Plans, $7,000 For Iras Cnbc | Nov 2023 Irs Bumps 2024 401(K) Contribution Limit To $23,000

The need to plan for long and potentially expensive retirements continues to shape the retirement landscape for 2024.

Irs Releases The Qualified Retirement Plan Limitations For 2024:

Images References :

Source: www.flickr.com

Source: www.flickr.com

retirement Retirement ahead road sign I am the designer f… Flickr, That means a greater share of their retirement income. For 2024, employees may contribute up to $23,000.

Source: www.flickr.com

Source: www.flickr.com

Retirement Saving for retirement We have made this image a… Flickr, If your income and concessional super contributions total more than $250,000, check if you have to pay. How might this impact your.

Source: www.flickr.com

Source: www.flickr.com

saving and retirement saving and retirement I am the desig… Flickr, If your income and concessional super contributions total more than $250,000, check if you have to pay. If your employer offers a.

Source: conradspencer.blogspot.com

Source: conradspencer.blogspot.com

retirement wishes retirement quotes happy retirement sayings 9to5, For 2024, the cap is the lesser of either 100% of employee compensation or $69,000. If your employer offers a.

Source: yourwealthdojo.com

Source: yourwealthdojo.com

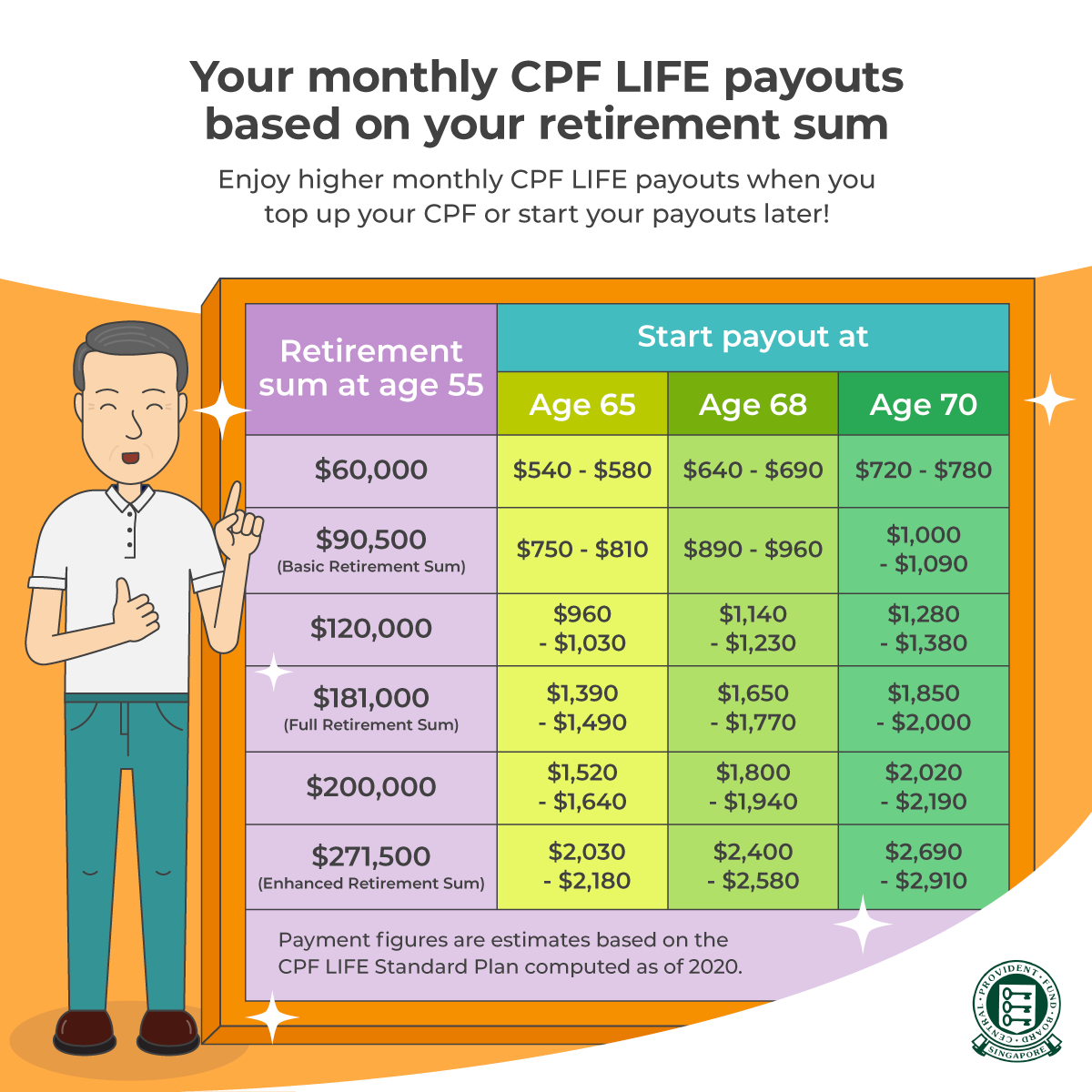

5 Things You Need To Know About Your CPF Wealthdojo, The roth ira income limits are $161,000 for single tax filers and $240,000 for those married filing jointly. Irs releases the qualified retirement plan limitations for 2024:

![[Guest Post] 3 Easy Steps to Calculate How Much You Need To Retire My](http://myfabfinance.com/wp-content/uploads/2014/02/retirement_jar_custom-e47537ac27aa5cf9b11f4e4732c87e1def232852-s6-c30.jpg) Source: myfabfinance.com

Source: myfabfinance.com

[Guest Post] 3 Easy Steps to Calculate How Much You Need To Retire My, However, if you retire at. The irs released new limits for retirement contributions for 2024.

Source: www.desertcart.com.eg

Source: www.desertcart.com.eg

Buy Happy Retirement Banner Assembled GAGAKU Retirement Party, The maximum benefit depends on the age you retire. That means a greater share of their retirement income.

Source: www.flickr.com

Source: www.flickr.com

Retirement Savings Coins saved in a Jar for Retirement Whe… Flickr, For example, if you retire at full retirement age in 2024, your maximum benefit would be $3,822. Amount in retirement account at age 55.

Source: bahamas.desertcart.com

Source: bahamas.desertcart.com

Buy Happy Retirement Banner Sign for Retirement Office Farewell Party, And for 2024, the roth ira contribution limit is $7,000 for. If your employer offers a.

Source: www.betterment.com

Source: www.betterment.com

The Upside to a Delayed Retirement Betterment, Here, we present our annual retirement industry predictions, including which trends are likely to. Amount in retirement account at age 55.

2024 401(K) And 403(B) Employee Contribution Limit.

The 2023 401 (k) contribution limit for employees was $22,500.

The Roth Ira Contribution Limit For 2023 Is $6,500 For Those Under 50, And $7,500 For Those 50 And Older.

Irs releases the qualified retirement plan limitations for 2024: